The Infinite Banking Concept with Jayson Lowe and Richard Canfield – Hollywood Life

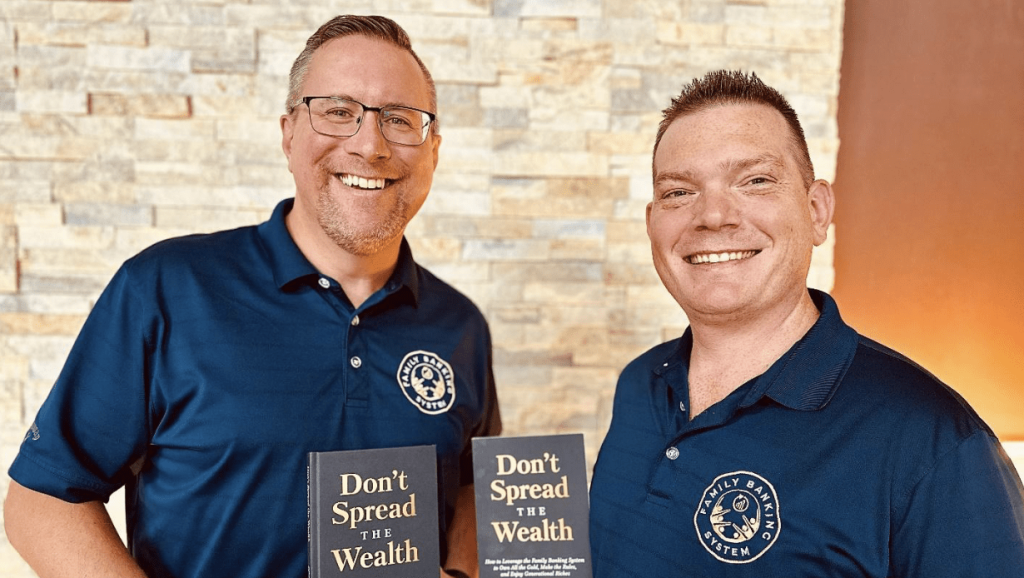

In today’s fast-paced financial landscape, many individuals and families find themselves trapped in a cycle of debt, limited by conventional banking practices and traditional financial advice. Jayson Lowe and Richard Canfield, Co-Founders of Wealth on Main Street, an education company delivering content to North Americans, and co-hosts of the popular Wealth on Main Street podcast, are on a mission to change this narrative.

Through their brand, “Wealth on Main Street,” powered by Ascendant Financial, they bring the transformative Infinite Banking Concept to the forefront of personal finance. This approach challenges the status quo, offering an education-first, not product-first, methodology that has garnered thousands of five-star reviews from satisfied clients across North America.

A Vision Rooted in Education

Jayson Lowe’s journey into the world of Infinite Banking began in 2008 when he recognized a fundamental flaw in how people manage their finances. As a Chartered Life Underwriter, he saw firsthand the limitations of traditional financial planning and the opportunities lost when individuals hand over control of their money to external entities. This realization inspired him to educate others on the Infinite Banking Concept—a process that empowers people to take control of how they finance all the things they need during a lifetime, such as investment opportunities, business equipment, homes, education, major appliances, cars, etc., ensuring that their money works harder and smarter for them.

“What sets us apart is that we help people by actually helping them,” Jayson explains. “Since inception, we’ve led with education, not products. We ensure that our clients understand how to take control of their finances, rather than just selling them something and moving on.”

This commitment to education is evident in every aspect of Jayson and Richard’s approach. Their team at Ascendant Financial provides comprehensive coaching and support, ensuring clients fully grasp the principles of Infinite Banking and how to apply them to their unique situations. Unlike many in the financial services industry who focus on transactions and sales, the entire team is dedicated to continually fostering a deep understanding of what their clients truly value, and then delivering that.

The Power of the Infinite Banking Concept

At its core, the whole idea of the Infinite Banking Concept is to recapture the interest that one is paying to banks and finance companies for all the major items that we need during a lifetime. It revolves around the fundamental truth that someone must perform the banking function as it relates to your needs. Most people unknowingly abdicate this responsibility, allowing traditional banks to profit from their flow of money while they forego control over their financial destiny. The Infinite Banking Concept flips this model on its head, giving individuals the tools to become their own bankers, and keeping the money where it belongs, within their own system

The fundamental truths of this concept are simple yet profound: your money must reside somewhere, so why not keep it in a place where you have total control, tax advantages, and guaranteed daily growth that cannot go backward? By storing money in specially designed dividend-paying life insurance policies, individuals can contribute almost unlimited sums, have ready access capital on demand, on their terms, and pay no tax on the daily build-up or on the death benefit, which is paid tax-free to their beneficiaries, exactly when it’s needed the most.

“The interest you pay the life insurance company would have been paid to someone anyhow, much better it goes to a company you co-own and share in all the profits,” Richard says. “Imagine if everyone you knew did this … you would have a closed-loop aquarium of capital where we all profit from one another’s combined interest payments.”

“Who doesn’t want a peaceful, stress-free way of life financially?” Jayson asks. “We’re not talking about changing any financial objectives our clients may have. Instead, we’re teaching them how to change the process of achieving those objectives in a way that reduces market risk, tax risk, and liquidity risk.” How would you feel if your money was no longer subjected to these risks?

Overcoming Challenges and Building Trust

Like any innovative approach, introducing the Infinite Banking concept to a wider audience has not been without its challenges. Jayson has faced skepticism and resistance from those accustomed to traditional financial planning methods. However, he has successfully overcome these obstacles by maintaining a steadfast commitment to transparency, education, and client-centered service.

“We’re accountable only to our clients,” Jayson says. “When someone works with us, they don’t just get one advisor—they get our entire team, bringing all of our experience and resources to bear. This collaborative, team-based approach is a stark contrast to the transaction-focused mentality that dominates our industry.”

This dedication to putting clients first has earned Jayson and his team a reputation as the gold standard in Infinite Banking in North America. The thousands of five-star Google reviews from real clients are a testament to the impact of their work and the trust they have built since their journey began in 2008.

A Tribute to a Pioneer

Jayson and Richard’s work is deeply inspired by their late mentor, R. Nelson Nash, the pioneer of the Infinite Banking Concept and author of the bestselling book, Becoming Your Own Banker. Nash’s teachings laid the groundwork for a financial revolution, and both men are determined to carry his legacy forward.

“Our book, Don’t Spread the Wealth, is an extension of what Nelson pioneered and developed,” Richard shares. “We’re bringing these principles to the family level, showing real-life examples of how Infinite Banking can be applied not just individually, but as a strategy for family wealth management.”

Nash’s influence is evident in their approach to both his business and personal philosophy. They emphasize that understanding the problem is crucial in order for the solution to matter. By educating people on this problem, Jayson and Richard help them see the value in taking control of the banking function in their own lives.

Looking Ahead: Building a Legacy of Financial Freedom

Looking to the future, Jayson and Richard envision a world where more families understand and embrace the Infinite Banking Concept, using it to build lasting wealth and financial security. They dream of a financial system where individuals are no longer dependent on traditional banks and can enjoy the benefits of controlling how they finance all the things they need.

“Our goal is to continue developing a deep understanding of what our clients truly value and to deliver that consistently,” Jayson says. “We want every reader of our book to walk away with their eyes opened to an entirely new financial world—one that radically improves whatever they are currently doing or contemplating doing financially.”

Their dedication to spreading this message is evident in their work with Ascendant Financial, as well as their ongoing efforts to educate the public through their podcast, soon to be rebranded to Wealth on Main Street. Through these platforms, Jayson and Richards continue to share the principles of Infinite Banking, encouraging others to take control of their financial futures.

Take the First Step Toward Financial Independence

If you’re intrigued by the idea of becoming your own banker and want to learn more about the Infinite Banking Concept, Jayson and Richard’s book is a must-read. It offers a straightforward, accessible introduction to these powerful principles, providing readers with the knowledge and tools they need to start taking control of their financial destiny today.

Don’t let your hard-earned money slip through your fingers. Take the first step toward financial independence and explore the world of Infinite Banking with Jayson Lowe and Richard Canfield in their book Don’t Spread the Wealth and Wealth Without Bay Street. It’s time to reclaim control over your financial future and build a legacy of wealth for generations to come.

**Investing involves risk and your investment may lose value. Past performance gives no indication of future results. These statements do not constitute and cannot replace professional investment or financial advice.